Call Center Solutions for Banks and Financial Institutions

In the increasingly competitive finance and banking sector, credit institutions must optimize operations and enhance customer experience. Modern customers expect fast, accurate support precisely when they need it.

Meanwhile, many banks are still operating their call centers manually, lacking the capability to handle a large volume of calls simultaneously. This results in overload, long wait times, and decreased customer satisfaction.

Debt collection presents increasing challenges as overdue debts become more prevalent. Many organizations still rely on Excel-based management or underutilize existing software solutions, resulting in resource inefficiencies, slower cash flow, and negative impacts on sustainable growth strategies.

Where is the bottleneck in the banking and finance

Call center overload during peak hours

Call centers handle thousands of calls daily — ranging from customer support and loan consultations to fee reminders and debt collection. Manual processing leads to slow response times, missed customer interactions, and reduced service quality.

Lack of employee performance evaluation tools

Inability to monitor customer service performance, call quality, and task completion rates at the branch or individual level.

Fragmented and hard-to-integrate data

Call center, CRM, contract management, and fee reminder systems operate as silos without seamless integration. This fragmentation leads to manual workflows, inconsistency, and increased error rates.

Decentralized and uncoordinated debt collection

Case management via Excel with no centralized reporting or field team monitoring tools.

Call Center Solutions for Banks and Financial Institutions

IVR – Automated call answering system

Enables intelligent call routing to the appropriate department (e.g., loan inquiries → credit department, service complaints → customer service), reducing call center load, minimizing wait times, and enhancing customer satisfaction.

Integrated API

Integrates the call center with core systems (CRM, LOS, Core Banking) to ensure seamless data flow between customer service and core operations, eliminating duplicate work and reducing data errors.

Autodialer

Automated dialing from predefined lists for campaigns (fee reminders, document verification, satisfaction surveys, new product promotions), allowing agents to connect only on answered calls to maximize efficiency.

Live call monitoring

Enables call quality management through silent monitoring (without customer awareness), whisper coaching (guiding agents during live conversations), and three-way calling. These functions are critical for training, risk mitigation, and resolving complex scenarios.

QC Bot (Quality Control Bot

AI assistant automates call quality scoring by analyzing conversation content and customer sentiment against predefined, objective criteria.

Reporting & Monitoring

Enables real-time performance tracking by branch, campaign, or individual. Key metrics—including call volume, duration, and resolution status—are continuously updated to support timely and accurate decision-making.

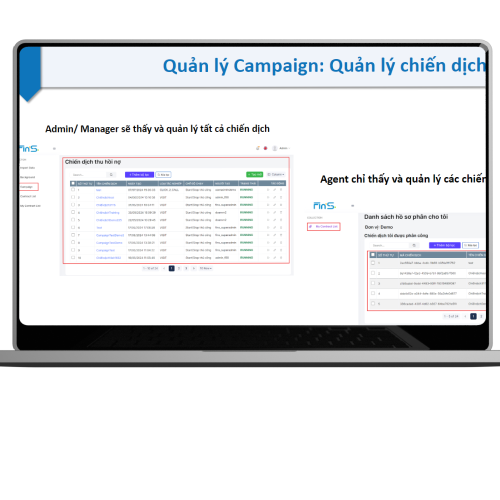

Development of dedicated CRM software for debt collection

In parallel with the Call Center, PiTEL’s specialized debt collection CRM system provides banks and financial institutions with comprehensive debt management and efficient recovery capabilities. Key products include:

FinS Collection: Loan information and customer portfolio management software

Field App: Mobile application designed for debt collection agents in the field

Contract and Debt Status Management: Full visibility into contract details, Days Past Due (DPD), debt classifications, payment history, and individual repayment commitments.

Debt Recovery Campaign Management: Configuration and execution of campaigns through AutoDialer, SMS, Email, Zalo ZNS, etc.

Personnel and Operation Monitoring: Tracking of agent status, field location, activity logs, and case handling results in real-time.

Field App for Field Agents: Mobile application for managing appointments, customer location mapping, activity updates, photo capture, note-taking, and on-site report submission.

Advanced Technology Integration: Automated SBC number rotation to prevent call blocking and ensure continuous connectivity; AI-powered voicemail detection to bypass voicemail calls; Voicebot for scenario-based customer interaction during debt recovery campaigns.

REQUEST A QUOTE

FINANCIAL INDUSTRY SOLUTIONS

We deliver end-to-end solutions tailored for the financial sector, optimizing costs to help organizations reduce training expenses without compromising effectiveness.

- 18001562

- sales@pitel.vn

Benefits of PiTEL Call Center Solutions for the Banking and Financial

Effortless customer engagement: Efficiently handle customer requests and inquiries, swiftly directing them to the relevant specialized departments (e.g., service feedback, account opening, internet banking support, credit card advisory) for prompt resolution.

Accurate and transparent storage of customer information and transaction history enables staff to promptly assess customer status, facilitating personalized support and advisory services. This minimizes customer wait times, reduces dissatisfaction, and maintains the organization’s professional reputation.

Functions as a marketing channel for financial enterprises to promote products, deliver customer care, and acquire potential clients. This reduces expenses and staffing needs for costly marketing activities while effectively communicating product and service offerings to customers.

Smart dialing technology boosts daily outbound call volume by up to 3x compared to traditional methods, while reducing agent idle time by 99%.

Consolidates critical debt details, notes, and campaign information to ensure accurate communication and up-to-date customer contacts. Providing agents with a unified platform allows them to concentrate on debtor interactions instead of managing multiple tools.

Why Choose PiTEL Call Center Solutions

PiTEL Call Center is developed on a globally standardized technology platform, featuring scalability, API integration with third-party systems, and customization tailored to specific business workflows.

The solution is certified with PiTEL Call Center software copyright and meets stringent banking security standards for customer data and transaction protection.

Enables personalized interactions and eliminates missed calls via Softphone support on desktops and the PiTEL Connect mobile app, allowing agents to work flexibly from any location.

Provides dedicated 24/7 technical support through the PiTEL (TEL4VN) team, with continuous updates incorporating the latest banking industry technologies.

Widely Adopted by Enterprises: PiTEL Call Center Solutions

Currently, numerous financial and banking institutions—including TPBank, Easy Credit, and Collectius—leverage PiTEL’s Call Center system to improve customer service efficiency, streamline debt collection, and optimize transaction handling.

The PiTEL Call Center solution, integrated with CRM Collection, offers an optimal platform for banks and financial institutions seeking to boost customer service and debt recovery performance, ensure data security, reduce operational costs, and enhance customer experience. Utilizing AI technology, multi-channel integration, and streamlined processes, PiTEL enables financial organizations to drive robust digital transformation.

Experience PiTEL Solutions

Get special pricing on PiTEL’s comprehensive solution suite, enabling you to optimize marketing strategies and accelerate business growth.

- 18001562

- sales@pitel.vn